U.S. Supreme Court Strikes Down Trump Tariffs: Latest News & Insights

In a major decision, the U.S. Supreme Court (SCOTUS) struck down the Trump administration's global tariffs -- the President's signature economic policy. SCOTUS ruled that the President does not have the authority under the International Emergency Economic Powers Act (IEEPA) to impose tariffs "of this magnitude and scope". Congress retains its constitutional power over "Taxes, Duties, Imposts and Excises." The decision, which marks a major check on the executive branch, will reverberate for some time and there are a number of implications to consider in the coming days and weeks.

For now, it's likely that the administration will use other (more limited) mechanisms: "Section 122 of the Trade Act of 1974 allows the administration to impose tariffs to address trade deficits, but those tariffs are limited to 15%, and can only be imposed for 150 days. Likewise, Section 301 of the 1974 Trade Act or Section 232 of the Trade Expansion Act of 1962 allow the president to impose tariffs, but only after a fact-finding by the U.S. Trade Representative and the Commerce Department." Following the decision, Pres. Trump imposed a 10% global tariff — becoming the first president to invoke Section 122 of the Trade Act of 1974, which allows the president to levy tariffs of up to 15% for up to 150 days. As this plays out, what happens to the trade deals negotiated over the past year and the administration's use of tariffs as a major tool in foreign policy (not just economic policy)? Could the administration go through Congress to secure a legislative path? This is a possibility but much harder now given Republicans' razor-thin majority in the House and pending Midterms.

Additionally, thousands of American businesses impacted by the tariffs could use the "duty drawback" provision to secure billions of dollars in refunds ($142B collected so far). The "duty drawback" provision does not apply to all businesses and there will be a messy legal fight ahead. Businesses may also expect and plan for a more predictable trade environment -- without the threat of sweeping tariffs. It's also worth noting that some companies (e.g. Costco) filed a lawsuit filed a lawsuit against the Trump administration in late 2025 in the U.S. Court of International Trade, seeking a full refund of duties paid on imported goods. Today's SCOTUS decision will only strengthen Costco's argument. American consumers, who have absorbed some of the downward price pressures as businesses passed on costs, may find some relief in the mid-term. Curated articles enclosed below.

EDITOR’S NOTE: TBG provides global solutions focused on Sustainability, Innovation and Impact. We leverage a Global Network comprised of more than 1000 experts in over 150 countries. Through TBG Consulting, TBG Global Advisors, TBG Purpose and TBG Capital, we undertake a wide range of projects — from Kenya to Kazakhstan — and transform challenges into opportunities.

CURATED ARTICLES (FEBRUARY 20, 2026)

“Supreme Court strikes down Trump tariffs, rebuking president’s signature economic policy” (CNBC)

The Supreme Court on Friday struck down a huge chunk of President Donald Trump’s far-reaching tariff agenda, delivering a major rebuke of the president’s key economic policy.

The law that undergirds those import duties “does not authorize the President to impose tariffs,” the majority ruled six to three in the long-awaited decision.

The ruling is a massive loss for Trump, who has made tariffs — and his asserted power to impose them on any country at any time, without congressional input — a central feature of his administration’s economic and foreign policies.

Chief Justice John Roberts delivered the opinion of the court. Justices Clarence Thomas, Samuel Alito and Brett Kavanaugh dissented.

Trump’s legal stance “would represent a transformative expansion of the President’s authority over tariff policy,” the majority concluded.

They noted that before Trump, no president had ever used the statute in question “to impose any tariffs, let alone tariffs of this magnitude and scope.”

To justify the “extraordinary” tariff powers, Trump must “point to clear congressional authorization,” the court wrote. “He cannot.”

The ruling was silent on whether tariffs that have been paid under the higher rates will need to be refunded.

Kavanaugh wrote in his dissent that the refund process “is likely to be…”….

Click here to read the rest of the article.

“7 key things to know about Trump's tariffs after the Supreme Court decision” (NPR)

The Supreme Court ruled Friday that President Trump overstepped his authority when he ordered tariffs on imports from nearly every country in the world, using a 1970s "emergency" statute.

Here are 7 things to know about what's at stake.

Tariffs are raising a lot of money — but not as much as Trump claims

The federal government has been collecting about $30 billion in tariffs every month — or about four times as much as it took in before Trump returned to the White House.

Trump has raised tariff rates to their highest level in nearly a century, but import taxes are still a small share of overall government revenue — just over 5% in January.

The tariff bill would be higher were it not for exemptions granted to certain imports such as coffee and bananas. Importers have also tried to cut their tariff costs by shifting production to countries where the administration has ordered a lower tariff rate.

In 2024, for example, 12% of U.S. imports came from China. By September of last year, that had fallen to about 8%.

Most of the cost of tariffs is being paid by U.S. businesses, and in some cases, their customers.

A working paper from Harvard professor and former IMF economist Gita Gopinath and Brent Neiman of the University of Chicago estimates that nearly all of the cost of Trump's tariffs are being paid by U.S. importers, not foreign suppliers as Trump has claimed.

In some cases, importers have absorbed that cost, settling for lower profits. In others, they've passed the additional cost on to customers in the form of higher prices….

Click here to read the rest of the article.

“The Supreme Court Got It Right on IEEPA—But Don’t Pop the Champagne Yet” (The Cato Institute)

The Supreme Court’s decision to strike down President Trump’s International Emergency Economic Powers Act (IEEPA) tariffs is a welcome victory for constitutional governance and the rule of law. But anyone hoping this spells the end of the administration’s tariff spree should think twice. Even without IEEPA, the president retains ample statutory authority to quickly recreate much of the current trade policy chaos.

Some of these are familiar. During Trump’s first term, he invoked Section 301 of the Trade Act of 1974 and Section 232 of the Trade Expansion Act of 1962 to hit China and impose steel and aluminum tariffs. Yet US law provides other tools that have largely escaped notice. Two lesser-known provisions—Section 122 of the Trade Act of 1974 and Section 338 of the Tariff Act of 1930—could let the administration continue its tariff onslaught even without IEEPA.

What the Court Got Right

Before diving into those statutes, it is worth noting what the Supreme Court got right. When the administration invoked IEEPA to impose sweeping tariffs on nearly all imports, it stretched a 1977 sanctions law well beyond anything Congress intended. IEEPA was designed to let presidents freeze assets and restrict financial transactions during genuine emergencies. The law does not function as a switch in the Oval Office for presidents to unilaterally rewrite virtually the entire tariff code passed by Congress.

The Court’s decision provides practical relief for Americans suffering from the administration’s ill-advised tariffs. Businesses have been whipsawed by tariff rates that changed seemingly by the hour during the spring chaos. The Tax Foundation estimates that the IEEPA tariffs increased taxes on American households by about $1,000 in 2025 and will tack on another $1,300 in 2026. The unpredictability, especially for small businesses, was almost as damaging as the rates themselves.

But the end of the IEEPA tariffs does not mean an end to unilateral trade policy. The administration has already been…

Click here to read the rest of the article.

“Trump tells governors Supreme Court tariff decision is a ‘disgrace’” (The Hill)

President Trump called the Supreme Court’s decision striking down a bulk of his tariffs imposed under emergency powers “a disgrace” during a private meeting with governors on Friday, a source familiar told The Hill.

The court’s decision came just as Trump was hosting governors for a breakfast at the White House. He is expected to brief reporters this afternoon from the press briefing room, White House press secretary Karoline Leavitt said on the social platform X.

The decision came down from the high court during the meeting, marking a significant defeat for Trump, who has made tariffs a centerpiece of his economic agenda.

In a 6-3 ruling, the justices rejected Trump’s expanded use of the International Emergency Economic Powers Act (IEEPA) in imposing tariffs on nearly every country. The 1970s law allows the president to “regulate” imports when necessary to respond to national emergencies that pose an “unusual and extraordinary” threat.

“We claim no special competence in matters of economics or foreign affairs,” Chief Justice John Roberts wrote.

We claim only, as we must, the limited role assigned to us by Article III of the Constitution. Fulfilling that role, we hold that IEEPA does not authorize….

Click here to read the rest of the article.

“Supreme Court ruling against Trump tariffs will offer relief, business owners say” (CBS News)

Business owners said that a Supreme Court ruling on Friday striking down sweeping U.S. tariffs could spell relief by lowering their costs and potentially leading to refunds.

The high court ruled that President Trump does not have the authority to impose levies on imports under the International Emergency Economic Powers Act, or IEEPA. Mr. Trump last year invoked the 1977 law to impose tariffs on dozens of U.S. trade partners, claiming that trade deficits and the flow of fentanyl and other illegal drugs into the U.S. constitute national emergencies.

Beth Benike, co-founder of Busy Baby, which makes mealtime accessories for babies, said that uncertainty about the legal status of the IEEPA tariffs had forced her to halt all imports from China, where the Minnesota-based company's products are made. She also has inventory in China that her manufacturer is holding for her overseas.

"I should have had it shipped last month, but I was waiting for the Supreme Court decision, because it was the difference between paying an extra $48,000 [in tariffs] or not," she told CBS News before the Supreme Court issued its long-awaited decision on Friday.

Not all businesses opposed the emergency tariffs. Before the high court's ruling, Drew Greenblatt, owner of Maryland manufacturer Marlin Steel told CBS News on Friday that he….

Click here to read the rest of the article.

“Trump tariffs live: Trump vows to impose 10% global tariff after Supreme Court rules sweeping duties are illegal” (Financial Times)

Trump vows to impose 10% global tariff after Supreme Court rules sweeping duties are illegal

Donald Trump has vowed to impose a 10 per cent “global tariff” using an alternative law after the Supreme Court ruled that his sweeping duties are illegal.

In a press conference following Friday’s landmark rebuke from America’s top court, Trump said: “Other alternatives will now be used to replace the new ones that the court incorrectly rejected.”

“We have alternatives, great alternatives could be more money, we’ll take in more money,” he added.

Trump said he would impose a 10 per cent levy on top of “our normal tariffs already being charged”, using the Trade Act of 1974, which allows the president to set import restrictions for up to 150 days.

It was not immediately clear which existing duties the president was referring to.

Earlier on Friday, the Supreme Court ruled in a 6-3 vote that Trump exceeded his authority in using the International Emergency Economic Powers Act to impose tariffs on dozens of countries.

The decision marked the…

Click here to read the rest of the article.

“Trump furious after Supreme Court upends his global tariffs, imposes new 10% levy” (Reuters)

U.S. President Donald Trump responded with fury to Friday's Supreme Court ruling that he lacked the power to unilaterally set tariffs on imports, denouncing individual justices as he vowed to continue a global trade war that has kept the world on edge for a year.

Saying he was undeterred by what he repeatedly called a ridiculous ruling, Trump announced an immediate new 10% tariff on imports from all countries, on top of any existing tariffs, and then issued a proclamation putting them into effect. The law allows him to impose a levy of up to 15% for 150 days, although it could face legal challenges.

The court's landmark 6-3 ruling upended the leverage Trump and his trade envoys have wielded over foreign governments at negotiating tables to reshape diplomatic relations and global markets.

The ruling briefly sent U.S. stock indexes surging, before ending modestly higher as analysts warned of renewed confusion in global markets while they await Trump's next moves.

Hours after the ruling, Trump signed an executive order repealing the tariffs that the court struck down, and he also issued a proclamation imposing a 10% duty on most goods imported into the U.S. for 150 days, granting exemptions for certain items including critical minerals, metals and energy products, the White House said.

Trade Deals, Revenue in Question

The ruling called into question the trade deals Trump's envoys have negotiated in recent months under the threat of high tariffs. It left open the fate of…

Click here to read the rest of the article.

OLDER POSTS:

President Donald Trump has sharply escalated his tariff campaign, unveiling a 35% duty on the majority of imports from Canada, set to take effect August 1, with carve-outs remaining for USMCA-compliant goods and Canadian energy and fertilizers. At the same time, trade talks with the European Union have been intensifying: key negotiations during mid‑July have culminated in an eventual agreement to cap tariffs at 15% , though steel and aluminum remain subject to higher rates. Pressure has also ramped up on India, with a 25% tariff announced on Indian goods effective August 1, coupled with an unspecified penalty tied to India’s continued Russian energy and military purchases and its involvement in BRICS. Talks remain alive, but leaders warn this move could destabilize negotiations. Click below for more information and select articles curated by the TBG Global Advisors team. Bookmark this page and check back regularly for new updates.

EDITOR’S NOTE: TBG provides global solutions focused on Sustainability, Innovation and Impact. We leverage a Global Network comprised of more than 1000 experts in over 150 countries. Through TBG Consulting, TBG Global Advisors, TBG Purpose and TBG Capital, we undertake a wide range of projects — from Kenya to Kazakhstan — and transform challenges into opportunities.

CNN — Trump plans to impose a Russia ‘penalty’ on India in addition to a 25% tariff as trade talks stall

July 30, 2025 President Donald Trump declared that the U.S. will impose a 25% tariff on all Indian imports starting August 1, 2025, citing India’s ongoing purchases of Russian oil and military hardware as the primary reason. Trump described India's trade and geopolitical stance as "disappointing," accusing New Delhi of “failing to align with U.S. strategic interests.” The tariff will cover a wide range of goods, including textiles, pharmaceuticals, and automotive parts.

The announcement comes amid stalled trade negotiations, with Trump explicitly stating there will be no deadline extension and warning that tariffs could rise to 35% or higher if India does not shift its posture. He also hinted at potential sanctions or broader economic penalties if India continues to deepen its Russia ties. Indian officials expressed dismay but have not yet announced a countermeasure. Markets reacted with caution, with the Indian rupee falling and export-reliant industries bracing for impact. Continue reading here and here.

Reuters — US and EU avert trade war with 15% tariff deal

July 27, 2025 President Donald Trump has struck a major trade framework with the European Union, imposing a sweeping 15% baseline tariff on nearly all EU goods, including autos, semiconductors, and pharmaceuticals—well below the previously threatened 30%–50% range. The agreement also secures commitments from the EU to invest $600 billion in the U.S. economy, purchase $750 billion in American energy products (including LNG and nuclear fuel over three years), and acquire U.S. military equipment. However, steel and aluminum tariffs will remain at 50% and later shift to a quota system, while strategic goods like aircraft parts, certain chemicals, generic drugs, and semiconductors benefit from zero-for-zero reciprocal tariffs under the deal

Despite the relief in averting a full-scale trade war, European leaders expressed criticism: France denounced the deal as a “submission,” and analysts warn the tariff hike from pre-existing rates averaging near 1% could slow European growth and inject inflation into U.S. consumer prices, particularly in pharmaceuticals, where analysts expect $13–$19 billion in added costs. Investors reacted with mixed signals—European stocks cooled and the euro slipped, while gains in U.S. futures and major indices reflected cautious optimism about reduced trade uncertainty. Continue reading here, here and here.

Reuters — Trump announces 35% tariffs on Canada

July 10, 2025 President Donald Trump announced via a formal letter that the U.S. will impose a 35% tariff on most Canadian imports starting August 1, citing Canada’s “unfair retaliatory tariffs” and its role in the cross-border flow of fentanyl. The statement noted that Canadian energy and fertilizer exports would be exempt, as would goods covered under the USMCA that meet domestic processing thresholds.

In Ottawa, Canadian Prime Minister Mark Carney condemned the move as “economic coercion” and called it a violation of North American trade norms. Canadian officials signaled that retaliatory tariffs were under consideration, while provincial leaders and trade unions urged swift countermeasures. Several Canadian industries, particularly lumber and dairy, are expected to be hit hard.

From a U.S. economic perspective, analysts warned that the tariffs could disrupt North American supply chains and raise prices on construction materials, packaged foods, and automotive parts. The move also heightened diplomatic tension in the lead-up to the August 1 enforcement date, with economists forecasting a short-term spike in inflation and uncertainty in trade-dependent sectors. Continue reading here.

BBC — Trump threatens Brazil with 50% tariff and demands Bolsonaro's trial end

July 9, 2025 President Donald Trump, citing the criminal trial of former Brazilian President Jair Bolsonaro as a “witch hunt,” announced in a letter via Truth Social that the U.S. will impose a sweeping 50% tariff on all Brazilian imports starting August 1. Trump tied the tariffs to Brazil’s domestic politics and its regulation of U.S. social media platforms, describing them as “political interference” .

In Brazil,, President Luiz Inácio Lula da Silva vowed to retaliate under Brazil’s newly passed reciprocity law, pledging matching tariffs “like-for-like” if the U.S. proceeds. Brazilian leaders, including top Congress figures, rallied around Lula’s stance, framing the tariffs as a matter of national sovereignty. Public response in Brazil included street protests and governmental unity .

Economically, analysts forecast significant fallout—particularly in U.S. consumer markets. A 50% tariff on Brazilian beef and coffee could drive up prices for burgers and daily cups of coffee in American households. Key Brazilian exports—coffee, beef, orange juice, aircraft, and machinery—are expected to take particularly hard hits, with some industries scrambling to find alternate markets even as exporters in Brazil search for buyers beyond the U.S. Continue reading here, here and here.

Reuters — Trump says BRICS nations to get 10% tariff 'pretty soon'

July 8 2025 - In a campaign-style rally on July 8, 2025, President Donald Trump announced that the United States would impose a 10% tariff on all imports from BRICS countries—Brazil, Russia, India, China, and South Africa—stating the move would happen “pretty soon.” He framed the decision as a direct response to BRICS’ ongoing efforts to reduce global reliance on the U.S. dollar, calling their actions a form of “economic warfare” against American interests. The White House did not confirm a precise implementation date but said the policy would take effect swiftly through executive action.

A day earlier, Trump had warned via a CNBC interview that any country “aligning themselves with the anti-American policies of BRICS” would also face an additional 10% tariff, regardless of whether they are BRICS members themselves. This expanded threat brings dozens of U.S. trading partners under potential scrutiny, including countries in Southeast Asia, Africa, and Latin America with increasing diplomatic or financial ties to BRICS. Trump emphasized that “there will be no exceptions” and that countries choosing to “undermine the United States economically” would be penalized.

The dual announcements mark a sharp escalation in Trump’s global trade posture and signal a return to the aggressive, unilateral tariff strategy seen during his first term. Analysts have warned that such moves could prompt widespread retaliatory measures, deepen trade tensions, and weaken diplomatic ties, especially with countries that are U.S. allies but also maintain economic relationships with BRICS. Read more here and here.

NBC — Trump's tariff deadline delay brings hope, confusion to trade partners, businesses

July 7, 2025 – President Trump signed an executive order extending the deadline for his proposed “reciprocal” tariffs from July 9 to August 1, giving trade partners extra time to negotiate bilateral deals and avoid steep duties. This formal extension was clearly outlined in a Reuters report, which noted letters detailing 25–40% tariffs had already been sent to about 14 countries, including Japan, South Korea, and the Philippines .

According to NBC News, the extension has generated both hope and confusion: some governments welcomed the breathing room as a diplomatic opportunity, while others remain uncertain about the criteria for exemptions and fear that the short reprieve may not prevent looming economic fallout .

The move is widely interpreted as a calculated negotiation strategy: a softer opening salvo that retains pressure and signals seriousness, while still providing a last-minute path to agreement. That said, officials and business leaders—especially in smaller, import-dependent economies—are warning that the extended deadline is only fueling continued investment hesitancy amid escalating global trade uncertainty. Continue reading here and here.

Reuters — US Court Blocks Most Trump Tariffs, Says President Exceeded His Authority

May 29, 2025 — “A U.S. trade court blocked most of President Donald Trump's tariffs in a sweeping ruling on Wednesday that found the president overstepped his authority by imposing across-the-board duties on imports from U.S. trading partners.

The Court of International Trade said the U.S. Constitution gives Congress exclusive authority to regulate commerce with other countries that is not overridden by the president's emergency powers to safeguard the U.S. economy.

Court cites that Constitution grants Congress power to regulate international commerce

Markets cheer ruling, dollar and global stocks rally

Trump administration files notice of appeal, questions authority of the court

Tariffs on autos, steel and aluminum remain in place

"The court does not pass upon the wisdom or likely effectiveness of the President's use of tariffs as leverage," a three-judge panel said in the decision to issue a permanent injunction on the blanket tariff orders issued by Trump since January. "That use is impermissible not because it is unwise or ineffective, but because [federal law] does not allow it."

Financial markets cheered the ruling. The U.S. dollar rallied following the court's order, surging against currencies such as…” (Click here to continue.)

BBC — US Markets Up in Early Trading After Court Ruling; What You Need to Know; Court Ruling a Blow to Trump but Tariffs’ Battle to Continue

May 29, 2025 —

What are the tariffs?

“Broadly speaking, Trump has increased tariffs in three ways:

A 10% tariff on almost every country - plans for some higher country-specific rates had already been paused

Higher rates for Mexico, Canada and China, linked to stopping the illegal flow of fentanyl into the US

Industry-specific tariffs, applying an additional 25% rate on steel, aluminium and cars

What has the court ruled?

It has effectively blocked the first two - the blanket 10% and fentanyl-related tariffs - arguing that it was not a legally valid move to use the emergency powers Trump cited when implementing them.

What happens now?

Experts are still grappling with what the implications will be. The ruling gives the Trump administration 10 days to take the steps needed to comply with the decision.

But the White House says it's appealing the ruling, meaning it will go to a higher court.”

What has the court ruled?

It has effectively blocked the first two - the blanket 10% and fentanyl-related tariffs - arguing that it was not a legally valid move to use the emergency powers Trump cited when implementing them.

What happens now?

Experts are still grappling with what the implications will be. The ruling gives the Trump administration 10 days to take the steps needed to comply with the decision.

But the White House says it's appealing the ruling, meaning it will go to a higher court. (Click here to continue)

CNBC — U.S. and China Agree to Slash Tariffs for 90 days in Major Trade Breakthrough

“The U.S. and China on Monday agreed to suspend most tariffs on each other’s goods in a move that shows a thawing of trade tensions between the world’s two largest economies.

The deal means “reciprocal” tariffs between both countries will be cut from 125% to 10%. The U.S.′ 20% duties on Chinese imports relating to fentanyl will remain in place, meaning total tariffs on China stand at 30%.

“We had very productive talks and I believe that the venue, here in Lake Geneva, added great equanimity to what was a very positive process,” U.S. Treasury Secretary Scott Bessent said in a news conference.

The U.S. and China on Monday agreed to temporarily suspend most tariffs on each other’s goods in a move that shows a major thawing of trade tensions between the world’s two largest economies.

The trade agreement means that “reciprocal” tariffs between both countries will be cut from 125% to 10%. The U.S.′ 20% duties on Chinese imports relating to fentanyl will remain in place, meaning total tariffs on China stand at 30%.

The breakthrough comes after U.S. and China trade representatives…” (Click here to continue)

US Treasury Secretary Scott Bessent (R) and US Trade Representative Jamieson Greer hold a news conference in Geneva on May 12, 2025, to give details of "substantial progress" following a two-day closed-door meeting between US and China top officials aimed at ending the tariff war.

Reuters — Reactions to US-China Tariff Cuts

“ Stocks and the dollar surged on Monday after the United States and China said they had agreed on a 90-day pause on tariffs and reciprocal duties would drop sharply, giving investors some confidence that a full-scale trade war may have been averted.

U.S. Treasury Secretary Scott Bessent, speaking after talks with Chinese officials in Geneva, told reporters the two sides had reached the deal that was outlined in a joint statement and that reciprocal rates would drop by 115 percentage points.

Charles Wang, Chairman, Shenzen Dragon Pacific Capital Management Co., Shenzhen:

"The result of the China-U.S. talks is certainly good news. Both sides have returned to reason and common sense. However, neither has changed the tough stance based on deliberation of national interest.

"The U.S. side has kept the 20% tariffs based on its hegemony and excuse over Fentanyl. In addition, if no deal is reached after 90 days, long-term tariffs will be 54% on Chinese exports and 34% on U.S. exports. That would be semi-decoupling.

"So today's news cannot be counted as being long-term positive. It's long-term positive plus 90 days of uncertainty."

Sheldon Macdonald, CIO, Marlborough, London:

“Our snap reaction is that this reduction is much bigger than expected. Yes, it’s only temporary, but the market is going to see this as confirmation that Trump doesn’t really want to cause the sort of disruption he has previously seemed to embrace.

“That said, if we assume the ‘steady state’ is 10% blanket tariffs and 30% on China, it’s still negative relative to the situation when Trump took over. It’s also still a negative for growth – just smaller than had been expected more recently – so there’s no ‘all clear’ on recession fears just yet.

“With positioning pretty ‘wrong way’ in a lot of assets, there’s potential for a bigger unwind. This could see risk assets up, the dollar up and a flatter yield curve. Conversely, safe-haven trades might soften. So once again we have sentiment, psychology and positioning in the driving seat rather than fundamentals.”

(Click here to continue)

NBC — Something Worse than Recession: Ray Dalio

“Bridgewater founder Ray Dalio said on Sunday that he’s concerned that the global monetary system will break down.

President Donald Trump’s tariff policies and growing U.S. debt are contributing to a new unilateral world order, Dalio said.

Dalio said the fallout from turmoil in bonds could be a more severe shock to the monetary system than the 2008 financial crisis.

Bridgewater founder Ray Dalio said on Sunday that he is worried that the turmoil resulting from President Donald Trump’s tariff and economic policies will threaten the global economy.

“Right now we are at a decision-making point and very close to a recession,” Dalio said on NBC News’ “Meet the Press.” “And I’m worried about something worse than a recession if this isn’t handled well.”

The hedge fund billionaire said he’s more concerned about trade disruptions, mounting U.S. debt and emerging world powers bringing down the international economic and geopolitical structure that has been in place since the…” (Click here to continue.)

<iframe loading='lazy' width='560' height='315' src='https://www.nbcnews.com/news/embedded-video/mmvo237257285807' scrolling='no' frameborder='0' allowfullscreen></iframe>

CNBC — These Household Items Have Gotten Pricier Since Trump’s Tariffs Announcement, New Report Finds

Not every day is a good day for Barbie, if prices for dolls in the U.S. keep rising amid President Donald Trump’s tariff policy announcements.

A series of household items including leggings, Barbie dolls power drills and washing machines have increased in price since Trump initially announced a sweeping set of global tariffs on April 2, according to an industry note issued by the Telsey Advisory Group on Tuesday.

Between April 16 and April 30, the price of a Target-exclusive Barbie doll increased by nearly 43% to $14.99, up from $10.49, Telsey reported. A Whirlpool washing machine at Lowe’s went up in price by nearly $82 to $599, over the same time frame.

Other notable price hikes include….”

CNN — What Trump’s Tariffs Mean for Fashion

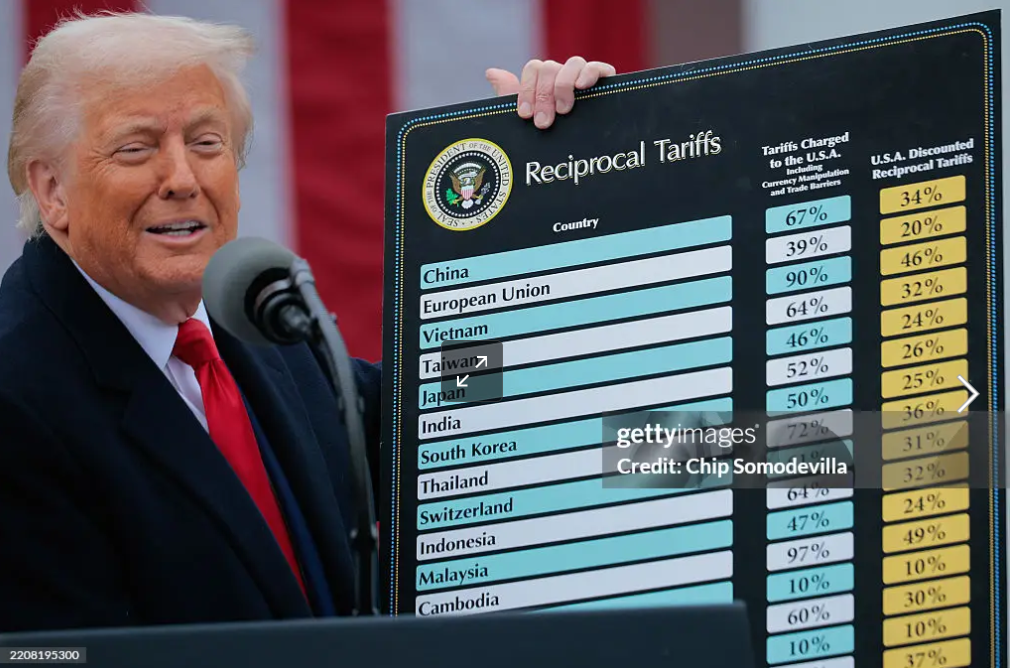

“The global fashion industry was left stunned on Wednesday after US President Donald Trump announced the highest and most comprehensive tariffs in nearly a century, with the most severe levies reserved for some of the biggest apparel manufacturing hubs.

In an address from the White House rose garden, Trump announced a baseline tariff of 10% on all imported goods. However, tariffs were set significantly higher on roughly two dozen countries where the US runs a trade deficit, with many of the fashion industry’s biggest production centers among them.

Goods from Vietnam — the second-biggest apparel exporter to the US after China — will be subject to a 46% tariff, Cambodia will have a 49% duty and Bangladesh 37%. China will be subject to a new 34% tariff on top of the previously announced duties, raising its tariff rate to 54%, and the EU will be hit with…” (Click here to continue)

FOREIGN AFFAIRS — “Trade Wars Are Easy to Lose: Beijing Has Escalation Dominance in the U.S.-China Tariff Fight”

“When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with,” U.S. President Donald Trump famously tweeted in 2018, “trade wars are good, and easy to win.” This week, when the Trump administration imposed tariffs of more than 100 percent on U.S. imports from China, setting off a new and even more dangerous trade war, U.S. Treasury Secretary Scott Bessent offered a similar justification: “I think it was a big mistake, this Chinese escalation, because they’re playing with a pair of twos. What do we lose by the Chinese raising tariffs on us? We export one-fifth to them of what they export to us, so that is a losing hand for them.”

In short, the Trump administration believes it has what game theorists call escalation dominance over China and any other economy with which it has a bilateral trade deficit. Escalation dominance, in the words of a report by the RAND Corporation, means that “a combatant has the ability to escalate a conflict in ways that will be disadvantageous or costly to the adversary while the adversary cannot do the same in return.” If the administration’s logic is correct, then China, Canada, and any other country that retaliates against U.S. tariffs is indeed playing a losing hand.

But this logic is wrong: it is China that has escalation dominance in this trade war. The United States gets vital goods from China that cannot be replaced any time soon or….” (Click here to continue)

REUTERS — “Impact of tariffs on developing countries could be 'catastrophic', says UN trade agency”

GENEVA, April 11 (Reuters) - Sweeping tariffs on imports imposed by U.S. President Donald Trump and countermeasures could have a "catastrophic" impact on developing countries, hitting even harder than foreign aid cuts, the director of the United Nations trade agency said on Friday.

Global trade could shrink by 3-7% and global gross domestic product by 0.7%, with developing countries the worst affected, the International Trade Centre said.

"It is huge," Pamela Coke-Hamilton, executive director of the International Trade Centre, told Reuters. "If this escalation between China and the U.S. continues it will result in an 80% reduction in trade between the countries, and the ripple effect of that across the board can be catastrophic."

Global markets remained in turmoil on Friday. Trump this week announced a…. (Click here to continue)