Saudi Arabia's (Green) Energy Agenda: How Decarbonization is Shaping Saudi Arabia's Future

Introduction

The world is undergoing a shift toward decarbonization, driven by climate change, technological innovation, and changing global energy demands. At the center of this transformation is Saudi Arabia—the world’s largest oil exporter. For decades, the kingdom’s economy and geopolitical influence have been tied to oil. Today, decarbonization presents Saudi Arabia with a pivotal choice—reinvent its economy and energy strategy, or risk losing its long-standing influence in the global energy landscape.

Saudi Arabia’s Oil-Dependent Economy

Oil has long been the backbone of Saudi Arabia’s economy. Oil revenue is made up 62% of state budget last year as stated by Reuters (2025). This dominance gives the kingdom significant geopolitical leverage, allowing it to influence global oil prices, energy security, and the strategies of both allies and rivals. However, this dependency also exposes Saudi Arabia to the risks of fluctuating oil demand, price volatility, and the accelerating global shift toward decarbonization.

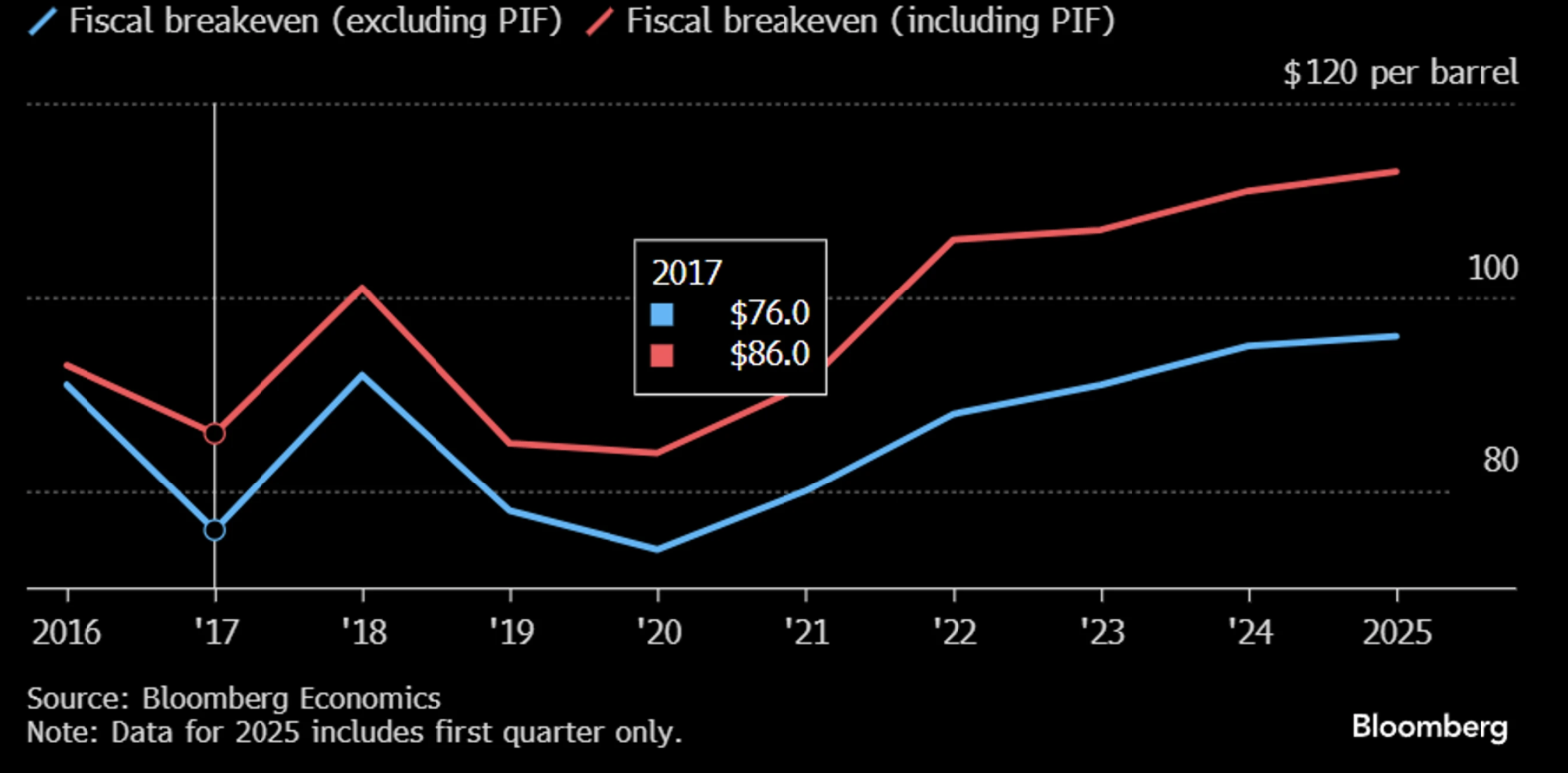

Figure 1 in Bloomberg’s article shows Saudi Arabia’s fiscal breakeven oil price — the oil price needed for the government to balance its budget. It is currently $96 per barrel, rising to $113 per barrel when including Public Investment Fund projects. Since Brent crude has averaged only $76.50 in 2024, this gap forces Saudi Arabia to borrow and sell assets, highlighting its continued heavy reliance on oil revenues.

Saudi Arabia’s Response: Vision 2030 and Beyond

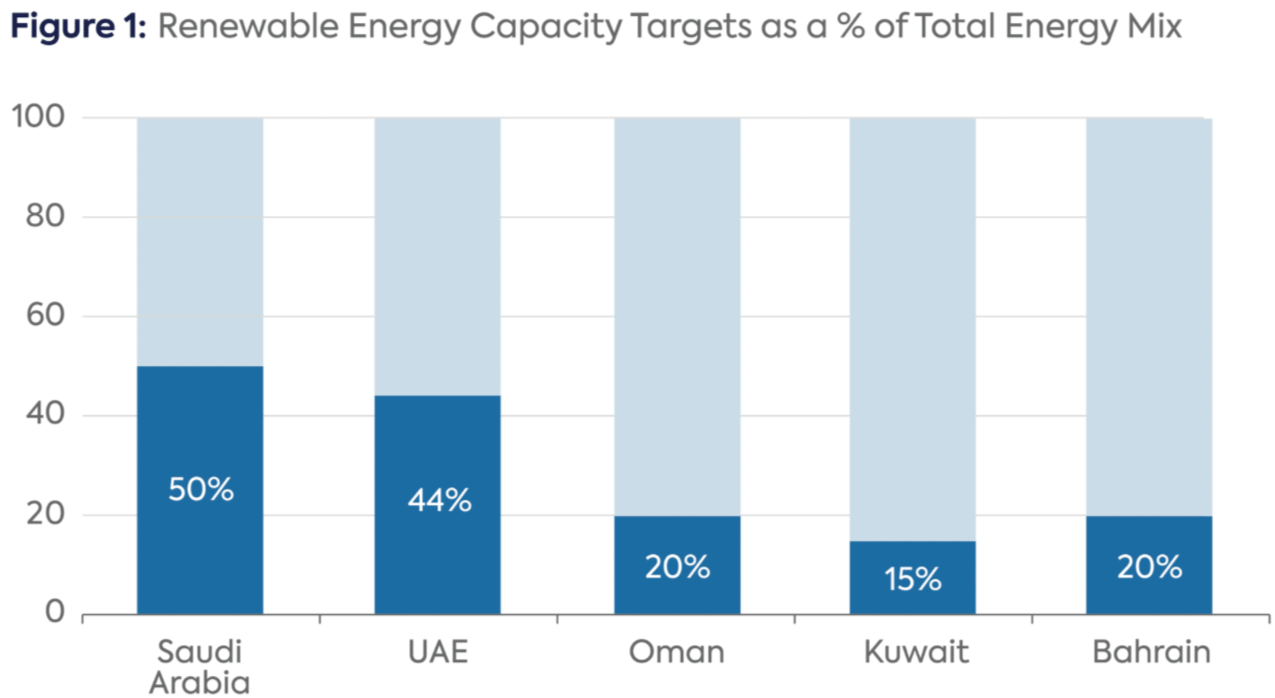

Saudi Arabia's Vision 2030, launched in 2016, aims to reduce the Kingdom's dependence on oil by diversifying its economy and investing in sustainable energy sources. A key component of this vision is the Saudi Green Initiative, which targets generating 50% of electricity from renewable sources by 2030 and achieving net-zero carbon emissions by 2060. These targets show that, despite their dependence on hydrocarbons, Saudi Arabia is actively working to diversify its energy mix and reduce its long-term reliance on oil through strategic investments in clean and renewable energy.

Saudi Arabia's Vision 2030 has transformed the kingdom from a global oil powerhouse into a strategic hub for renewable energy and green hydrogen. It has committed $8.3 billion to develop 15,000 MW of renewable energy, including solar and wind projects across the kingdom. This investment supports Vision 2030’s goal of generating 50% of electricity from renewables by 2030 (AInvest).

Vision 2030 is more than policy — it’s a blueprint for transformation. Signature projects such as NEOM and The Line highlight the Kingdom’s ambition to become a global renewable energy and innovation hub. Along signature projects like NEOM, The Future Investment Initiative (FII), a prominent yearly conference organized by the Public Investment Fund (PIF) as part of Saudi Arabia's Vision 2030 plan, aims to place the Kingdom at the center of international investment flows. The FII brings together top executives from industry, government, technology, and finance to share ideas, make big announcements, and speed up global cooperation.

Learning from Norway

Norway provides an instructive model for Saudi Arabia’s transition. Norway has successfully balanced oil production with a robust renewable energy sector while using its sovereign wealth fund (Government Pension Fund Global) to invest globally in sustainable projects. The Saudi Public Investment Fund (PIF) has expressed interest in emulating Norway’s strategy — diversifying revenue streams and securing long-term stability in a post-oil world.

Opportunities and Risks

Saudi Arabia has the ability to lead the world in exporting hydrogen and renewable energy. As part of Vision 2030's clean energy objectives, the Kingdom has pledged $8.3 billion to create 15,000 MW of renewable energy, including wind and solar projects. Beyond the financial gains, these initiatives might increase Saudi Arabia's geopolitical influence and solidify its standing as the leading regional force in the Middle East. Riyadh could establish a standard for energy leadership in the area and draw in international investment and strategic alliances by spearheading the development of hydrogen and renewable energy (ESW News).

This chart from the Center on Global Energy Policy shows that Saudi Arabia has the most ambitious renewable energy target among these Gulf countries, reflecting its strong commitment to diversifying its energy mix under Vision 2030.

Despite ambitious plans to diversify its energy portfolio, Saudi Arabia faces several challenges in its renewable energy transition. The Kingdom's economy remains heavily dependent on oil revenues, which constitute a significant portion of its GDP and government income. This dependency could hinder diversification efforts. Additionally, the transition to renewable energy may be slower than anticipated due to technical, financial, or regulatory challenges (AP News). Geopolitical instability in the region may also affect investment flows and the stability of energy infrastructure. These factors underscore the complexities Saudi Arabia faces in balancing its energy ambitions with economic and geopolitical realities.

Comparisons to Gulf States

Saudi Arabia is not alone in pursuing energy diversification. Gulf neighbors such as the UAE, Qatar, and Oman have launched similar strategies. For example:

UAE: Aiming for 50% clean energy by 2050, led by Masdar City and nuclear power projects. Additionally, the UAE's National Hydrogen Strategy 2050 targets an annual production of 14 to 22 million tons of hydrogen and hydrogen derivatives by 2050.

Qatar: Investing heavily in solar energy as part of its National Vision 2030. The country is investing heavily in renewable energy, such as the 2,000 MW Dukhan Solar Power Plant, and deploying smart city projects like Lusail and Msheireb to optimize energy efficiency.

Oman: Focusing on wind and solar projects to reduce dependency on oil.The government, under Oman Vision 2040, is actively investing in solar, wind, and green hydrogen to diversify the energy mix, reduce carbon emissions, and attract foreign investments. Oman aims to produce 30% of its electricity from renewables by 2030.

Conclusion

Decarbonization is not just an energy shift — it is reshaping Saudi Arabia’s economy, strategic influence, and role in the global energy landscape. For a nation whose prosperity has long depended on oil, the shift toward renewable energy presents both an unprecedented challenge and a historic opportunity. The choice before the Kingdom is clear: adapt to the renewable future or risk long-term economic and geopolitical decline. How Saudi Arabia responds will not only define its own future but also influence the broader trajectory of the global energy transition.