The Iran Situation: How Regional & Global Chokepoints Can Disrupt Global Energy Markets

Introduction:

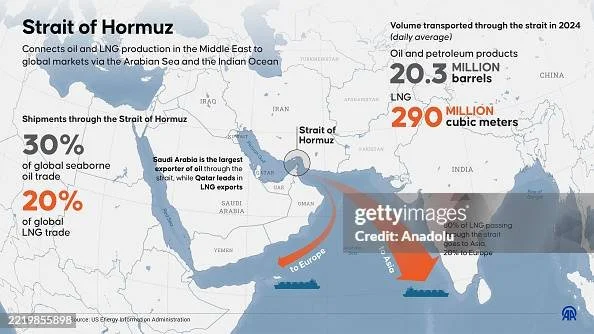

The ongoing conflict between Israel and Iran has heightened fears about a potential shutdown of the world’s most critical energy chokepoint, the Strait of Hormuz. We have already seen the Houthis, an Iranian aligned proxy militia, cause global economic and international trade disruptions through their attacks on ships travelling through the Bab al-Mandab Strait off the coast of Yemen, and the addition of a closure of the Strait of Hormuz would prove to be catastrophic for the global energy trade. As of July 2025, a fragile ceasefire is holding after the Iranian parliament approved a nonbinding draft to shut down the strait in retaliation for the U.S. airstrikes targeting the Iranian nuclear installations. The decision is waiting for approval from Iran’s Supreme National Security Council (Reuters). While Iran continues to posture militarily through its missile and naval mine deployments, an actual closure of the of the strait seems unlikely, for now (Reuters). Yet the specter of closure prompts serious global economic concerns.

Iran’s Strategic Calculus:

Closing the Strait would be a double-edged sword for the Islamic Republic. Iran maintains control of the northern side of the narrow waterway and is theoretically capable of mining or launching attack boats to block traffic through this chokepoint. While this would negatively affect their adversaries, it would also deal a blow to the Iranian economy as well as to their allies who rely on the cheap supply of oil from Iran. In particular, 90% of the Iranian oil supply exported to China moves through this strait (The Week). Tehran’s top security council now holds the decision-making power to decide whether or not a closure will be in Iran’s geopolitical interest under current circumstances.

Global Markets: Prices, Volatility, and Modern Risk Assessments

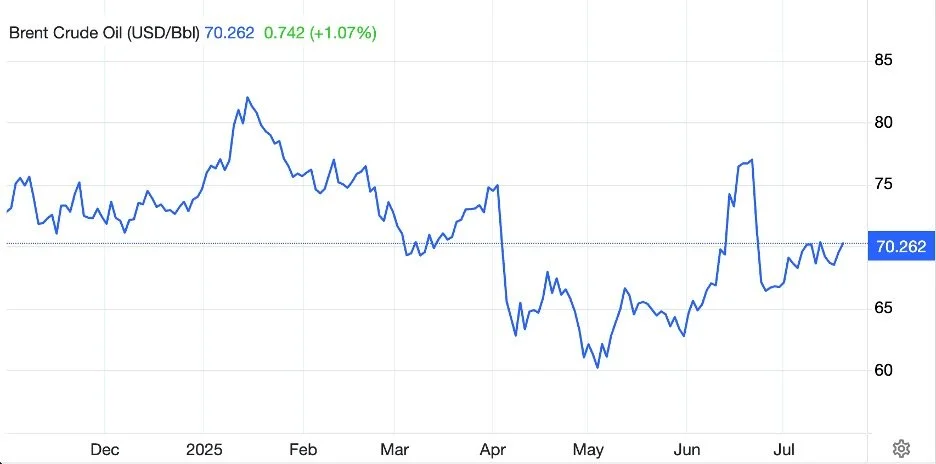

According to the most recent data, approximately 20 million barrels per day pass through the Strait of Hormuz, which equates to ~20% of global oil and LNG flows (EIA). During the June 2025 flare up of the Israel-Iran conflict, Brent crude prices spiked to mid-$70s per barrel, with futures closing in near $80 per barrel (The Guardian). This represents approximately 23% increase from the beginning of June 2025. Goldman Sachs and ANZ economists have warned that a temporary closure of the strait could lead to a decline of 0.3% in Global GDP and increase inflation by 0.7% (The Guardian).

Markets have recently shown resilience and after Israel’s initial missile strike and Iran’s response, oil prices fell 7%, driven by traders’ confidence that the conflict would not disrupt shipping and that the global energy supply remains plentiful (Washington Post). In addition, Iran’s measured response to the U.S. bombing of nuclear installments soothed the markets fears, at least for now, of a larger scale conflict with more direct confrontation between the three actors. Although some concerns have been tamped down at the moment, a prolonged exposure has been forecasted to increase Brent Crude prices to $110-$130 per barrel (The Guardian). This kind of event would be reminiscent of the market after Russia invaded Ukraine in 2022.

Economic Costs for Iran:

Beyond its own export earnings, Iran relies heavily on the strait to reach key customers. Shutting or disabling the passage would interrupt nearly all of Iran’s seaborne trade, including oil, LNG, and general commerce (Reuters). This self-inflicted economic harm would not only place a further drag on the Iranian economy, but would also pose an issue for the regime with its constituents who would suffer from this action. Compounding this, the US has issued warnings and increased diplomatic pressure on Tehran in regards to a potential closure of the strait (Reuters). The U.S. has made it clear they will not sit idly by while Iran engages in actions they do not condone. A closure of this passageway and subsequent potential rise in oil prices for a U.S. economy still tackling inflation after pandemic-era surplus seems like something that would fall into this category. The Iranian government must weigh domestic economic fallout against its military signaling.

Global Economic Shockwaves:

Energy Inflation & Supply Chain Disruption

A sudden spike to $110+ per barrel in oil would affect every economy, raising fuel prices, heating bills, and transportation costs. Economists estimate global growth could decline by about 0.3% percent while prices increase by approximately 0.7% (The Guardian). High-income and commodity importing countries would both feel the strain.Shipping Costs and Insurance Premiums

Even the threat of disruption slows maritime traffic, and Bimco has reported tanker delays and that insurance premiums have surged due to this military and geopolitical conflict (Financial Times). These moves have mirrored the effects of the disruptions in the Bab al-Mandab Strait. Prolonged disruption could reroute tanker fleets via the longer Cape of Good Hope route, which would add days in transit and increase transportations costs (Reuters).Regional Disruptions

Asia is especially vulnerable to these potential disruptions, with nearly 84% of Hormuz’s oil and 83% of LNG flows heading toward China, India, Japan, and South Korea (The Week). These economies, already struggling with sluggish post-COVID growth, would be forced to scramble for an alternate supply of energy.Investor Sentiment and Market Ripples

Conflicts like this makes financial markets nervous. Currently, lenders are repricing sovereign credit risk, while oil producers like Chevron, ExxonMobil, and tanker stocks have already seen elevated trading volumes due to conflict risk. A long, drawn-out conflict could tighten capital flows, push rates, and weigh on equities globally.

Compound effect with Houthi’s Red Sea attacks:

On July 8, 2025 the Houthi launched their most recent attack on two Greek-operated, Liberian-flagged cargo ships in the Red Sea using drones, missiles, and rocket-propelled grenades (AP News). This attack has prompted insurance premiums for Red Sea voyages to more than double, crossing the 1% value mark and driving some operators to reroute ships around the Cape of Good Hope (Financial Times). Another wave of prolonged attacks by the Houthis would compound any disruption in the Strait of Hormuz. The Bab al-Mandab Strait, in combination with the Suez Canal, accounts for approximately 12-15% of global trade by volume, which involves 30% of global container traffic, 10% of seaborne oil, and 8% of LNG flows (Reuters). A coordinated trade blockade by the Houthis and Iran would prove incredibly troublesome for international trade and the global economy.

Conclusion: A Tenuous Deterrence

A full shutdown of the Strait of Hormuz would create economic pain that would permeate the world. Iran’s reluctance to self-harm, compounded by U.S. warning, China’s energy dependence, and alternative routes (such as Saudi east-west pipeline and UAE’s Fujairah terminal) indicate that while threats will persist, closure remains unlikely (EIA). That said, the global economy cannot afford complacency. Even temporary disruptions inject volatility into oil markets, strain global inflation, and shake investor confidence. Policymakers and businesses should prepare contingency plans by building reserves, diversifying energy sourcing, hedging costs, and reinforcing regional alliances, including enhanced maritime security cooperation.

Sources:

https://www.reuters.com/world/china/us-urges-china-dissuade-iran-closing-strait-hormuz-2025-06-22/

https://theweek.com/business/economy/why-the-worlds-busiest-shipping-routes-are-under-threat

https://www.theguardian.com/business/2025/jun/22/oil-prices-expected-to-rise-after-us-attack-on-iran

https://www.washingtonpost.com/climate-environment/2025/06/22/oil-prices-iran-strait-hormuz/

https://www.ft.com/content/503b9f75-f3a0-40b1-bc64-a9f2ffd7376f

https://www.reuters.com/markets/commodities/red-sea-suez-trade-routes-houthi-threats-2024-12-18/